|

|

Welcome to MarketTrak's S&P 500 Forecast for the Next Trading Day.

Our advanced neural network analyzes market data to generate a trading signal

for the S&P 500 ETF, SPY for the next trading day. This signal is calculated

shortly after the market closes and is typically published here during the

after-hours session, ahead of the futures market reopening.

|

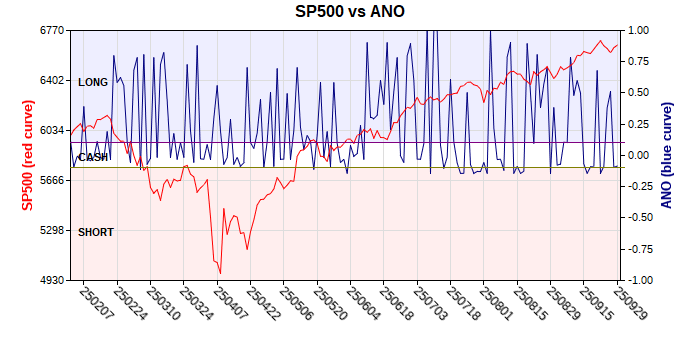

Our forecasts are based on end-of-day market data and an experimental AI model trained to predict the direction of the S&P 500 for the next trading day. While our model aims to provide valuable insights, no model is perfect, and financial markets are subject to numerous surprises. We strongly advise cross-verifying trades with other sources and implementing stop-loss orders to manage risk effectively. Our model remains in cash for Tuesday's session. If this page does not look current, try refreshing it by pressing the CTRL and F5 keys. Forecast Model: The neural network model is optimized to maximize the total return over the last two months. The model is experimental and is presented here for information purposes only. Its accuracy, which varies considerably over time is usually greater than 75 percent based on a moving 60 day average. A positive ANO value in the Summary above implies that the SP500 should close higher the next trading day. A negative ANO value implies that the SP500 should close lower. More details about the neural network model is provided here. Click here for a roadmap of this page. Click here for performance data. Click here for our message board. Follow us on Twitter Computing the Neural Network Forecasts:

We use an advanced neural network model and

a genetic learning algorithm to create hundreds neural networks used to forecast the close of the SP500.

The output of a single neural network is a numerical

value that ranges from minus one (-1.0) to plus one (+1.0), with -1.0 being a very

strong indication that the sp500 will close lower the next trading day

and +1.0 being a very strong indication that the sp500 will close higher the next trading day.

The trading position we show in the Summary above is determined by computing

an average network output value (ANO) from each individual network and applying this average value

to the setpoints which are also shown above. When this ANO rises above the long setpoint, a

long position is given. We expect the market will close higher. When the ANO falls below the short setpoint, a short

position is given. We expect the market will close lower. A cash position is indicated when the ANO lies between these

two points. We expect the market will have little change.

A five percent trailing stop is given to reduce risk when either a

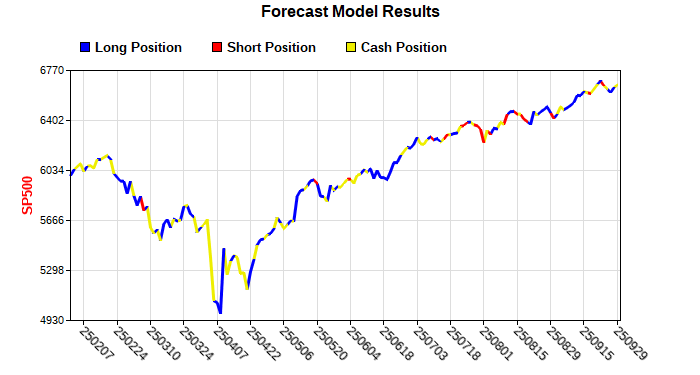

long or short position is indicated. Model Results: Trading results for the network model covering the last 165 trading days are shown in the two charts below. The vertical grid lines in these charts are 10 trading days apart.

The different color regions in the first chart correspond to the three possible trading positions. The second chart shows the trading positions as determined by the forecast model. Performance Data: Performance of the forecast model is shown in the table below. The results are given for three time periods. The first column of data shows results since the beginning of this calendar year (Y-T-D). The second column of data shows results for the last 165 trading days, and the third column shows results for the last 45 trading days or about the last two months. The drawdown is the maximum drop in any position during the total days shown. The table below and the charts above show blind predictions of the model used at the time. Previous results are not altered to reflect model changes and therefore some of the 165 predictions shown may not represent the behavior of the current model. Page Top

Model Output Data: The table below shows the results of calculations using our neural network forecast model. The data in the table were computed by averaging the results of more than 200 networks trained on 7800 days of stock market data.

Disclaimer: Our models are experimental and can change at any time. You may use our forecast as long as you totally agree with the following terms and conditions: Our mission is to make our forecast the best available, but we do not guarantee its accuracy or profitability. We provide the forecast on an “as is” and “as available” basis without any warranty of any kind. Specifically, MarketTrak disclaims any and all warranties, expressed or implied, including without limitation warranties of merchantability, profitability, and fitness for a particular purpose. In no event shall you hold MarketTrak liable for any direct, indirect, incidental, punitive, or consequential damages of any kind whatsoever. You bear full responsibility for your own investment research and investment decisions. Nothing in our forecasts should be interpreted as a recommendation or solicitation to buy or sell any security, or to take any specific action. The opinions or comments expressed may change without notice. You determine if and how the forecast is used in your investments. You recognize that past performance does not indicate future results. Click here for a complete disclosure of our disclaimer. This site does not set cookies. Page Top Site Links:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||