|

Message:

Hello,

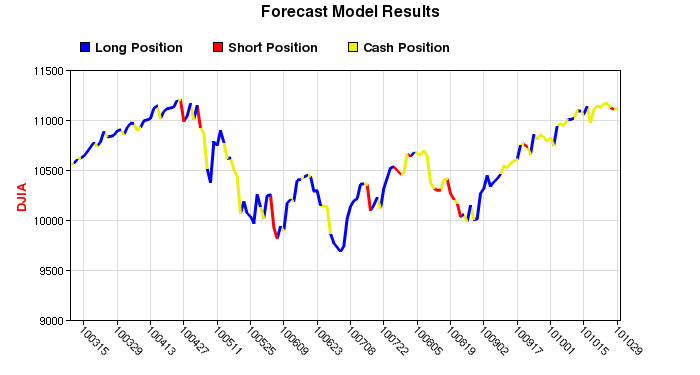

A look back at the last 165 days graph, with coded colors for buy/short/cash

, shows no clear pattern for opportunistic buying or shorting. The market tanked

from 11k to 10k, then bounced back up from 10k to 11k -- with what appears to

be straightforward momentums , but unfortunately the model didn't take advantage

of them. It feels to me a bit of a coincidence that the model is up 5% over 165

days, and buy&hold is also up 5%. But the model could have just as easily been

down 5% based on the graph, which doesnt seem to show a systematic trading pattern..

I feel based on the dip to 10k and rise to 11k, the model should have achieved

at least a 10% return at this point in the year... sorry for giving you a bit

of a hard time, I am only looking at the outcome of the model and do not comprehend

the algorithms behind it, but I do think a discussion about performance is worthwhile

|

|

Response:

Last year was an exceptional year for us with a return of 51 percent but

as you have pointed out, we have been struggling this year. We made several minor

network weighting changes to version 25, a version we had used for almost two

years, but that did not correct the performance problem. On October 2, we

installed a model update (version 26) which looks promising. Unfortunately, since

we do not go back and change past results, the performance data for this version

previous to the update are not shown in the graphs and table on the forecast

page. I can show here, however, what the trading performance would have been

for the last 165 trading days. Below is a graph of version 26 results:

|